Lei feng's network (search for "Lei feng's network", public interest): the author drones channel (ID:auscor), concerned the drones.

Starting from 2012, to field Phantom generation UAV for representatives of consumer products into view, and the resulting product development and several rounds of unmanned investment boom. From Silicon Valley to New York, a lot of VC money into the UAV company, such as the well-known KPCB,Lightspeed Venture Partners, and FF Venture Capital. Not only that, many Giants began to take part, started investing in unmanned aerial vehicle industry, such as Google, Intel, General Electric and Qualcomm.

In such a hot investment, driven by 2015 Zano, Lily cool concept shows to attract the world's TOP media reports and reprints, but eventually ended in failure of the project. Early 2016 is dominated by open source 3DR announced massive layoffs and stop a consumer-level drone operations (Drone-maker 3D Robotics cuts jobs and refocuses on corporate market), managers Kalanithi internal communication mail acknowledged that "we defeated the reason is so simple, we produce a lot of Solo (3DR the first consumer-level drone), Competitors quickly adjust prices allows market UAV market quickly became the Red Sea ".

Consumer market UAV market really has become the Red Sea yet? Through 7 pictures below takes you easily understand market pattern of consumer drones.

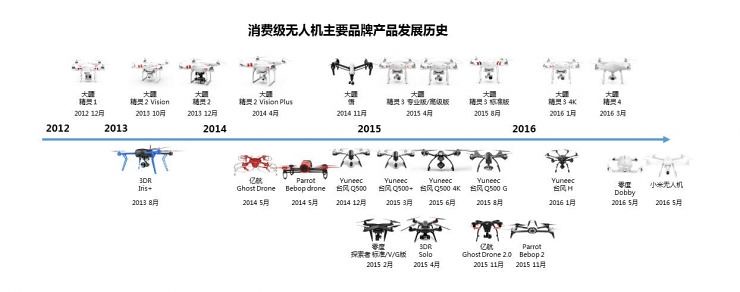

Figure one: consumer-level drone timeline (not including concept)

December 2012 big Xinjiang released has global first paragraph real meaning Shang of consumption level no machine Phantom 1 generation, opened has consumption level no machine of development prelude, then to 3DR, and Parrot, and zero, and billion airlines, and Yuneec for representative of the road manufacturers have pulled investment, input development and released their products, currently most products also in second generation, and big Xinjiang of Phantom series has update to fourth generation. Now what about the brand market share and sales?

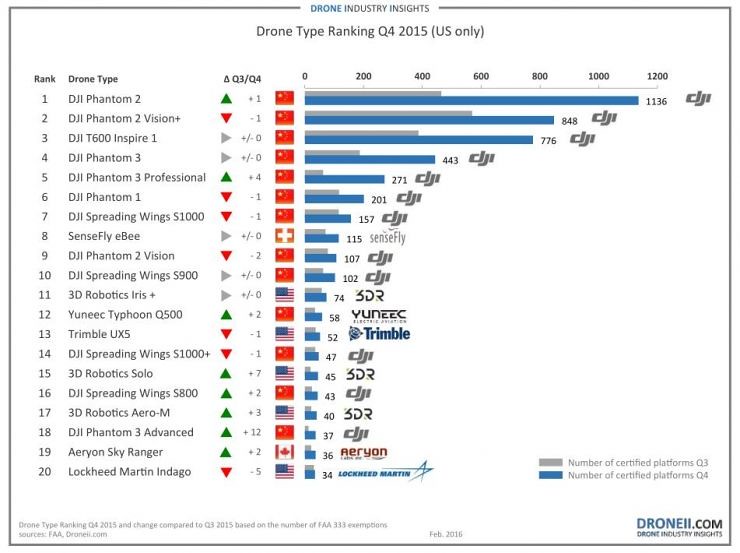

We take a look at comparison of the authority of the United States FAA statistics number apply for flying drones, although this is not a Terminal sales, but has always been recognized by the industry's barometer for the UAV market share, side support from official bodies UAV market share, credibility is very high.

Figure II: FAA application number of drones fly tab

Source: DRONEII.COM

By 2015 the fourth quarter in United States Federal aerospace Administration (FAA) has been adopted by the commercial drones flying permit application, the top 20 of the hottest models from the big 12 in Xinjiang.

According to the above statistics, United States enterprises applied to the FAA to fly unmanned aircraft models, Xinjiang drone scheme reference number to the total number of 90.17% can be described as monopoly. Sensefly and 3DR finished second and third, but the number of shares are in the single digits, is almost negligible.

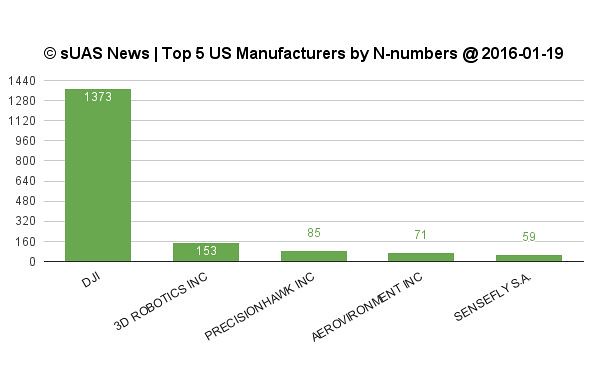

Read the FAA authority Agency statistics, and then comparing the third-party platform sUAS unmanned aerial vehicle registration information to statistics the number of statistics, TOP 5 registered in early January (as of January 19, 2016) professional user registration data, large parts of Xinjiang with 1373 ranked first, take the TOP5 of all registered 78.8%;3DR second, take the TOP5 of all registered 8.7%. The statistics, though not as FAA official authority, but is enough to reflect the mainstream consumer-level drone market. Consumer drones are still Xinjiang (DJI) dominance. Other UAV manufacturers and rounding to zero as the first name change.

Figure three: sUAS unmanned aerial vehicle registration statistics

Data sources: (DJI drones maintain market share in the USA)

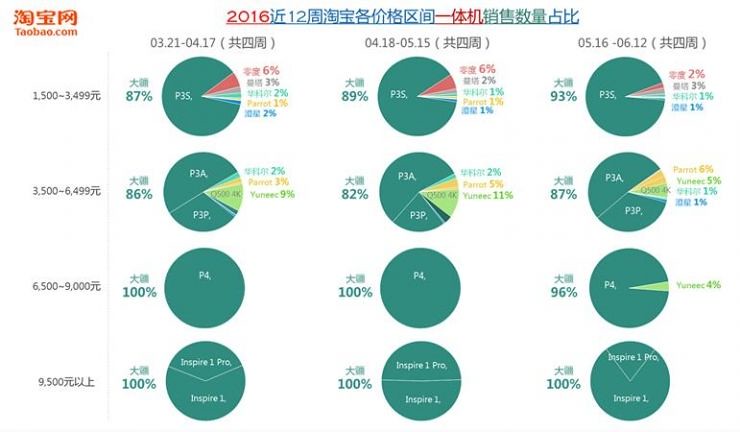

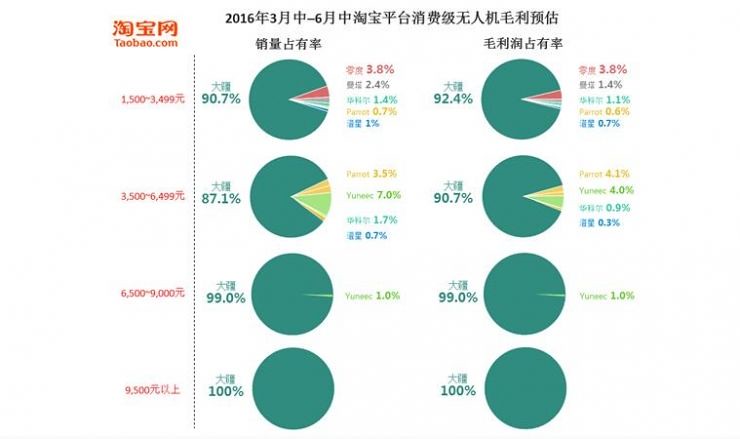

After reading foreign authoritative data, and then analyze the sales platform of the most representative – the company, the following data from third-party research firm. Figure four is today March 2016 – June 12 weeks a variety of mainstream consumer-level unmanned aerial vehicle sales share statistics.

Is not difficult to see from the table, 1500-3499 an entry-level price, large percentage of sales in the most recent four weeks of Xinjiang reached 93%, Manta, and zero in second and third, share in the single digits for 3% and 2%. 3500-6499 prices, frontier sales accounted for more than 87%,Parrot than 6%, Yuneec accounted for more than 5%, number of shares are in the single digits. 6500-9000 price, the most recent four-week-old frontier sales accounted for 96%, 9000 price above all dominated by Xinjiang Insprie series.

Figure four: March 2016 to June totaled 12 weeks major consumer grade UAV sales share statistics

This we cases lift about intelligent phone market of example, Apple sales number than Samsung, but profit is occupy has whole intelligent phone market of 90% above, so sales number also enough directly feedback market situation, according to each models of price and the estimates cost, according to industry internal people provides of supply chain analysis data and investment territories on no machine industry of margins analysis (for example biography big Xinjiang 2015 years net profit 250 million dollars CEO denied started financing), Figure under estimates the relationship between sales and gross profit share for each brand.

Results were a surprise, 1500-3499 entry price point, March 2016-June field Maori share a staggering 92.4%, zero 3.8%, Manta 1.4%, all other brands put together a mere 2.4%. Relative to the share of sales, improvement of field Maori share several points, which brings the cost of the marginal effects in the sales. 3500-6499 price, March 2016-June field Maori share 90.7%,Parrot 4.1%,Yuneec 4%, the remaining sum 2% not all manufacturers. 6500-9000 Yuan price, Xinjiang gross profit share of 99%. More than 9000 price 100%.

Figure five: March 2016-June mainstream consumer drones share sales and gross profit share of estimated Hello Kitty iPad Air 2 Case

Several different official agencies and third-party platforms shows you more than 1500 in all price segments, both the number of sales of Xinjiang, and the entire consumer-level drone market profits above 90%, after media reports usually refer to Xinjiang's market share of about 70% (the author presumably toys priced less than 1000 Yuan drone was one of the statistics). So from the perspective of consumer drones statistics, field sales and profits double "90%" gold share components, such as media content for "Xinjiang is the Apple drones."

It is obvious that other UAV manufacturers in the absence of HD, there is no visual technologies; and the main flight control, cloud, cameras, software and industrial design fully functional behind, while prices also disadvantaged circumstances, it's hard to compete with Xinjiang. At this point, the author at 3 characteristic drones summarizes consumer-level and 2 the truth the real market, for the enthusiasts, practitioners and investors interested in the industry reference.

Three main features

1, the technological threshold is very high. Not a few hardware pieced together to create a product out in the short term. The core algorithm such as flight control, take a number of years, generations of products an iterative optimization can only achieve industrial-grade reliability. Hello Kitty iPad Air

2, high security requirements, not just doing a simple cool electronics. Strict, consumer-level unmanned security requirements much higher than cars. Imagine a few kilograms to more than 100 meters altitude, if a failure occurs in free fall will be fatal plunge to the ground. Very high security requirements and high technical threshold is echoed, so drones can not fly the required hardware, software, algorithms, systems, such as a build up flight safety system. This is not a complete 5 years 10 years can be achieved, even decades of time.

3, policies and regulations are not clear, operational risk is extremely high. There is no country is a comprehensive consumer-level unmanned aircraft management regulations. As a manufacturer, faces a high level of operational risk, requires a huge team to communicate with all levels of Government to discuss manufacturing standards, standard management and spatial use. These higher costs than the cost of research and development investment. Is likely to product research and development, the Government suddenly announced manufacturing standards and practices, if they are not, will ban on direct sales.

Two truths

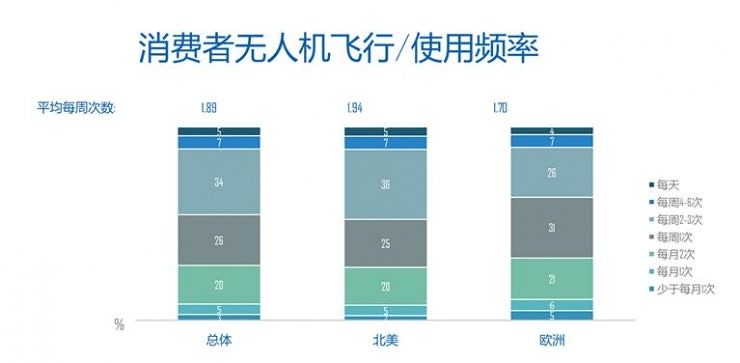

1, it is a small niche market, not the necessities of life, and no capacity of many claims of billions of dollars. According to a report on the authority, after many users bought the drone is placed as a work of art at home most of the time, average frequency of less than 2 times a week, unlike phone time in hand. Since it is a non-necessities, sales are not as car market of the order of tens of millions of, not like the Smartphone market is of the order of hundreds of millions of.

Figure six: consumer-level drone use

2, hot money investment, 99% the drain. A mass influx of hot money, money can be earned within a short time of gimmicks, but threw out the short-term accumulation of technology. Final sales conversion, everything is very beautiful, the reality is too skinny.

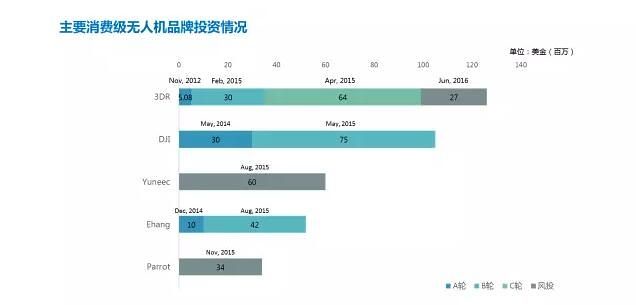

Figure VII: major consumer brand investment

Very clearly shown in the following figure in 2015, close to $ 300 million into 3DR\DJI\YUNEEC\EHANG\PARROT.

3DR financing amounted to $ 130 million from 2012, and announced massive layoffs earlier this year and put an end to consumer-level drone operations. Ehang won a $ 52 million investment, made headlines often, can't see their name in the sales reports. Yuneec received Intel6000 million dollars investment will be $ 60 million in annual sales is likely to make a question mark? Unfortunately so many VCs tried throwing money wasted. 2016 has so far found a UAV-related investment, 3DR a new $ 27 million in financing, is used to apply an unattended machine, rather than a consumer drone.

In just the past May 2016, millet has released its first drone, 4K prices dip below the 2999 Yuan. Intelligent zero also in May published a "Pocket" Dobby, a price tag of 1899, price directly to less than 2000 Yuan. Facing the Red Sea market for unmanned, it appears that VCs have to smell the taste of blood, not entirely reliable unmanned aerial vehicle project, did not dare to vote.

Unmanned hot in recent years by the media and hot blowing out of the infinite amount of bubbles, bubble burst, a lot of startups will fail, a lot of investment money will drain. Surge of hot money in an unreal concept was eventually someone has to pay. Hope this article on the UAV industry interested enthusiasts, practitioners and investors to be inspired. Technology advances rely on tireless engineers and fastidious consumers. The ground, keep the nature of perception of objective things, everybody just going the wrong way, mercy of was illusive concepts and interests.

No comments:

Post a Comment